Nine Surging Fintech Trends To Watch In 2021

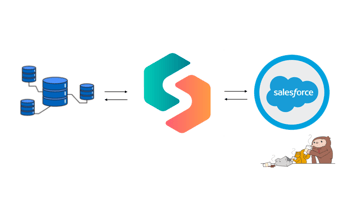

Sandbox Banking

Originally posted on Forbes.

With so many businesses and consumers relying on online transactions, the rise of financial technology has accelerated since the pandemic began. As remote operations stay in place for many companies and consumers adapt to—and embrace—technology to simplify their financial transactions, the growth in fintech is a trend that can be expected to continue.

From retail and banking to financial advisory services, it appears fintech will continue to transform the economy in the months ahead. Below, nine experts from Forbes Finance Council share the fintech trends they expect will rise in prominence in 2021.

Members of Forbes Finance Council discuss fintech trends that are surging in the wake of the pandemic. Not pictured: Sandeep Sood.

1. Enhanced Digitization Of Operations

The banking sector faces another wave of transition in the Covid-19 environment and is being forced to further digitize operations. The first wave of digitization was customer-focused in response to fintechs being business-to-consumer-oriented. However, a significant workload lies ahead for incumbents in consolidating and automating their mid- and back-office procedures, which is a much more profound, complex and costly process. - Lucia Waldner, CC Trust Group AG

2. Robotic Process Automation

Robotic process automation will play a bigger role. We have successfully and effectively worked remotely but are facing increased pressure to save money in our operations through efficient and effective programs. If RPA can help save money on human capital, reduce fraud and processing errors, and get payment discounts, it is a strategy we must all embrace. - William Guerrero, Ithaca College

3. Growing Variety Of Mobile Payment Options

Everyone should prepare for the booming variety of mobile payment options that will become widely available due to our current health climate. With social distancing, there’s a greater need for this type of technology. Businesses should be prepared to accept as many payment options as possible. My advice would be to keep your ears open and invest in those most requested by clients or prospects. - David Haass, Elite Insurance Partners, LLC

4. Partnerships With Financial Institutions

Fintech has traditionally been seen as a disruptor, upending legacy financial systems to offer innovative, technology-forward approaches and products. With fintech firms now more established and the technology more sophisticated, financial institutions are seeking to establish partnerships with them, licensing their technologies and leveraging them to benefit and expand their customer base. - Mary Jackson, Online Lenders Alliance

5. Increased Focus On Cost Savings

Financial institutions need to extract every efficiency out of their existing technology systems and labor force to handle increasing digital customer volumes while also being under income pressure from low yields and loan demand. This focus on cost savings will drive a new wave of business-to-business fintech experiences. - Ravi Balasubramanian, Sandbox Banking

6. Rise Of Embedded Finance

I’m watching the rise of embedded finance carefully because it’s the biggest existential threat to financial institutions. Social networks like Facebook and aggregators like Uber will soon be offering most of the services that people use banks to accomplish today. What happens to traditional banking after that? - Sandeep Sood, Kunai

7. Bigger Focus On Cybersecurity

Organizations and individuals need to have a heightened sense of awareness around the cyber threat landscape. People need to ensure they are practicing good cyber hygiene as well as not falling prey to the rising number of targeted phishing attacks. - Christopher Konrad, World Wide Technology

8. Capturing Real-Time Data For Underwriting

Fintech lenders will need to capture real-time data for underwriting. After months of disruption, traditional backward-looking metrics do not paint an accurate picture of a borrower’s creditworthiness today. Using real-time financial data like daily cash flow and rent payments to make lending decisions will help fintechs provide consumers and small businesses access to the capital they need to rebuild. - Jacob Haar, Community Investment Management LLC

9. Reliance On Behavioral Science Tech

As we look for ways to “know” clients we cannot meet in person, it’s feeding the use of artificial intelligence and other smart technologies to leverage behavioral science to hone in on data around innate client goals and behavior. Integrations are getting better at folding such information into existing platforms so that you’re enhancing existing systems, not supplanting them. “#BeSci” will soon be part of your fintech stack. - Wm. Scott Page, LifeGuide Partners