Early Payroll Processing and Loan Funding

Travis Walter

Early payroll is the exciting new business capability that banks are providing their customers. It allows workers to gain access to wages before a company’s normal payday. However, traditional manual processing prevents institutions from being able to offer early payroll at scale.

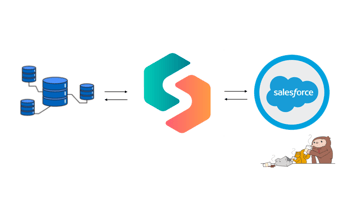

Customers are those that are down the road, like the local Starbucks or accounting firm. Customers rely on them to process their payroll in a timely and accurate manner. Sandbox Banking clients realize that increasing their product offerings will make them more competitive by providing their customers flexibility. This increases the ability to sell more features to more customers.

A bank being able to do this might allow them to:

- Offer data-dependent features (e.g. overdraft protection for individuals from corporate accounts)

- Offer near real-time fund availability

- Reconcile funds faster

Small Businesses (SMBs) often use banks to process their payroll as part of their banking package. Processing payroll is a slow and labor-intensive process for banks since it historically involved manual reconciliation. Banks, therefore, are looking for ways to automate this processing since it can allow them to offer data-dependent features to SMBs (e.g. advances on the payroll).

Within banks that cater to consulting companies and other types of SMBs, payroll validation is often done manually with complex and repetitive processes to ensure the payroll file only contains correct information before being sent to the FED. The need to validate ACH transfers follows from the bank customer capability being offered. Manually processing files creates significant overhead for these banks, which forces them to stay with product offerings that allow for the extended time it takes to process these files.

Users of solutions in this space are members and directors of operations within the bank. They are the members of the banks that are manually processing the files that Sandbox Banking is being sent. They already have processes in place, but see the potential benefit of integrating automation into their workflow to increase the speed and precision of processing. Users are able to use Glyue to build necessary NACHA file integrations themselves. If self-service isn't desirable, Sandbox Banking can provide solution delivery services to ensure customers receive the integrations they need.