Why the Banking Crisis Isn’t Over Yet

Sandbox Banking

In an article titled The Banking Crisis Has Only Begun, Forbes Senior Contributor Ron Shevlin wrote, “bankers shouldn’t delude themselves into thinking the industry is out of crisis mode.” Shevlin cited 5 reasons, one being zombie cores:

A person’s core has to be in shape—and so does a bank’s. Getting their core systems into shape has become either a nightmare or an impossibility for banks. The bank technology landscape is littered with what Cornerstone Advisors’ Brad Smith calls “zombie cores”—core apps that haven’t been sunsetted but are no longer supported by or enhanced by the tech companies that sold them.

Banks have two options throughout the rest of this decade: Core replacement or core modernization. Neither option is cheap and neither option is fast.

The good news for banks is that this situation has given rise to a new category of tech firms like Core10, PortX, Constellation, and Sandbox Banking—let’s call them core integration platforms—that promise to make it easier to integrate ancillary systems to existing cores and create a strategy for core replacement.

Read the full article on Forbes.com >

How Sandbox Banking Breathes New Life into Zombie Cores

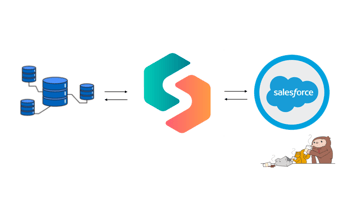

The Sandbox Banking platform Glyue™ helps banks and credit unions grow revenue and increase operational efficiency by securely integrating fintech products with their existing infrastructure. Sandbox Banking solves three common fintech challenges to help future-proof core banking systems:

- Securely and rapidly integrates fintech partners

- Scales across the business for future integrations

- Provides access to a library of fintechs & banking systems

"The infrastructure and product framework needed to integrate core banking and fintech systems has historically been plagued with complaints of incompatible systems that generate lengthy integration timelines, lack of customization beyond cookie-cutter integrations, and lack of agile support for future changes based on user behavior. Glyue makes this process seamless and more efficient than ever, and will continue to power the next generation of integrated digital banking systems that are unlocking fintech for society," said Ravi Balasubramanian, CEO of Sandbox Banking.

To learn more about modernizing your “zombie core,” request a Sandbox demo.